Access cash without selling investments

Access up to 50% of your invested funds and repay over a timeline that suits you.

Register your interest today to become an early user*.

Join the users that are already registered

How does it work?

You could sell your assets to access cash, or use Jamtomorrow using 4 simple steps;

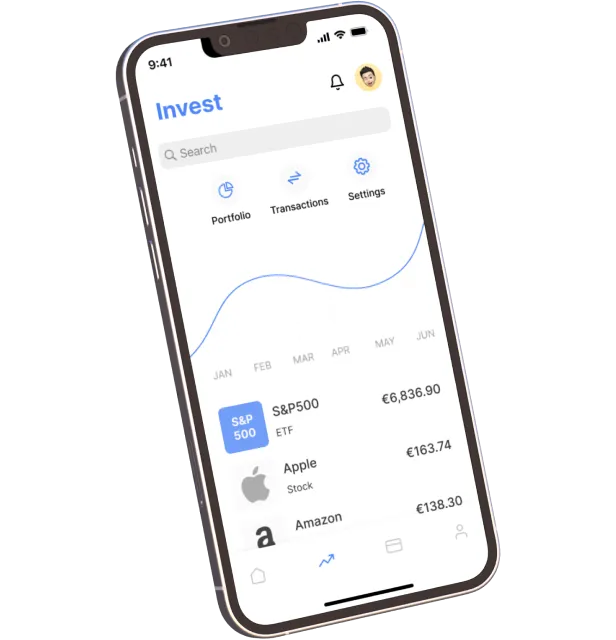

Invest

With €3,000 invested, you can borrow up to £1,500. 50% of the total amount you have invested.

Purchase

Use your account to purchase items up to £1,500.

Escrow

Your investment of £3,000, is held in a escrow account. You can not sell the investment

Repay

Repay the €1,500 over a time frame that suits you. Your investments are then returned with any profits.

Invest for the long-term

Select your investments and save monthly to build your portfolio

Invest from as little as €1 per month

Avoid short term selling taxes and fees

Enjoy the compound effect of long term investing

Benefits of long-term investing

If you invested for any 20 year period in the S&P500 you would have 100% chance of receiving more money than you invested.

Over shorter time frames the chance of having a positive return decreases.

73%

1 Year

87%

5 Years

94%

10 years

100%

20 Years

Short-term access to cash

Access your invested cash when you need to

Instant access of up to 50% of your invested amount.

0.5% interest per month.

No need to sell your investments.

Customer testimonials

Register today to join our early users and help shape JamTomorrow

Tom

Stuart

Alex

FAQs

We like to make things easy and have an option for you to deposit a fixed amount monthly and you can start investing from as little as €1. However you can also chose to make one off deposits.

No. Jamtomorrow works as a secured credit card, this means your credit is secured against your investment. If you do not pay your bill then your investments may be used to settle them. This means the lender has less risk so you do not need to have a good credit score.

You can use your credit for as long as you need. You won't be able to sell your investments until you have repaid in full.

When you use your account the investments will be placed into escrow. Escrow is an account which can not be accessed unless conditions are met. In this case you will not be able to access your investments until the balance has been repaid. When the balance has been paid your assets will be returned to you.

Your assets are placed in escrow when the transaction is made on your card. If you spend €1000, then €2,000 worth of your investment will be placed into escrow.

If the value goes up you will receive the additional value when the the balance is repaid.

If the value drops below the original €1000, more of your investment may be secured.

Unfortunately due to the requirement for us to place your investments into an escrow account you have to invest with us. We do not currently offer our services to investors at other companies or platforms